While consumers and fans of music know what songs they love, it turns out that big business really loves songs too. Especially song catalogs, which are bundles of songs that an artist created that include rights to exploit them. "Exploit them" means not only deriving the revenue from them when people buy a physical copy, download, or stream of a song, but also revenue from uses of a song in film or television, commercials, video games, and more.

In fact, song catalogs have grown from niche music-industry curiosities into mainstream investment assets. Several factors have converged to drive this boom:

• Streaming is king. As streaming platforms like Spotify and Apple Music dominate music consumption, catalogs—especially evergreen hits—generate steady, predictable revenue. In 2021, catalog music made up 70% of album consumption, up from 65 % the previous year, driven partly by nostalgia during the pandemic and the years since.

• Low interest rates. In the years since COVID-19, historically low rates made income-yielding assets like song catalogs more attractive compared to traditional bonds.

• Transparent performance data. Tools like Spotify and YouTube offer clear metrics, enabling better valuation and tracking, and therefore reduced risk for investors.

• Need for alternative income. When live touring was halted during lockdowns, it started a trend of many artists selling their catalogs as a financial lifeline.

This intersection of predictable royalties, tech-driven transparency, economic demand, and creative supply created the “perfect storm” for song catalog investments.

Record-Shattering Deals

The numbers speak volumes. Recent years have seen some jaw-dropping catalog sales:

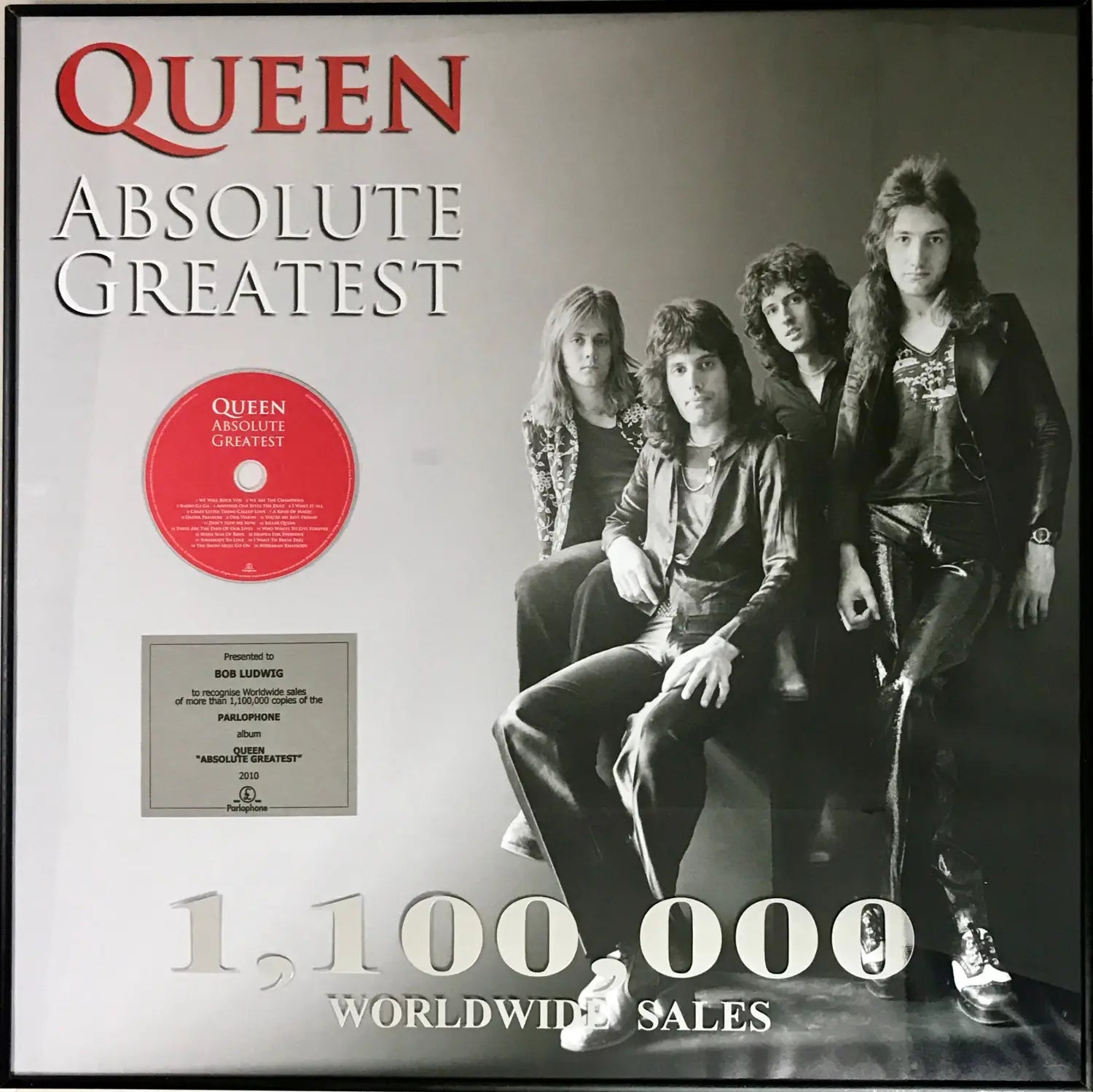

• Queen catalog — Acquired by Sony for around $1.27 billion in mid-2024, it currently stands as the largest catalog purchase in history.

• Michael Jackson catalog — Sony bought half for $600 million in early 2024, implying a total value around $1.2 billion.

• Pink Floyd — Sony paid approximately $400 million in late 2024

• Bob Dylan — Universal acquired the songwriting catalog for $300–400 million in 2020.

• Katy Perry — sold her first five albums’ rights for around $225 million in 2023.

• Justin Bieber — catalog sale for roughly $200 million.

• Other giants — Artists like Bruce Springsteen, Sting, Phil Collins, Paul Simon, David Bowie, and many more have cast shadows in the nine-figure arena.

Private equity and labels also launched major ventures:

• Warner Music + Bain Capital just recently unveiled a joint investment vehicle with up to $1.2 billion earmarked for catalog acquisitions.

• Hipgnosis, the pioneering catalog investment fund, raised billions, including $2 billion under Merck Mercuriadis, now planning a comeback with artist-centric co-ownership models.

These mega-deals confirmed song catalogs as valuable, institutional-grade assets.

Why Investors Are Hooked

Several compelling reasons underpin institutional appetite for music catalog rights:

• Resilience and diversification. Catalogs offer stable, inflation-hedged income that doesn’t correlate with volatile markets.

• High multiples. Catalogs often sell at 20–30× annual publisher share—well above the historical 8–12× range.

• Licensing potential. Music is monetized through sync placements in film, TV, ads, and games. Active catalog managers aggressively pitch their rights to maximize usage and revenue.

• Global expansion. Labels are snapping up catalogs from independent, Latin American, Indian, and other emerging markets to tap into growing streaming audiences.

• Secondary market growth. Platforms and funds provide liquidity to rights holders seeking exits, helping mature this asset class.

• Artist reputation matters. Catalog value depends heavily on a track record and audience familiarity. Older, consistently popular artists attract premium prices.

• Tech and regulation. Advancements in AI and blockchain improve fraud detection, royalty tracking, and valuation, while some regions mandate minimum streaming payouts, helping stabilize income.

Artists Regaining Control, Or Never Giving It Up In The First Place

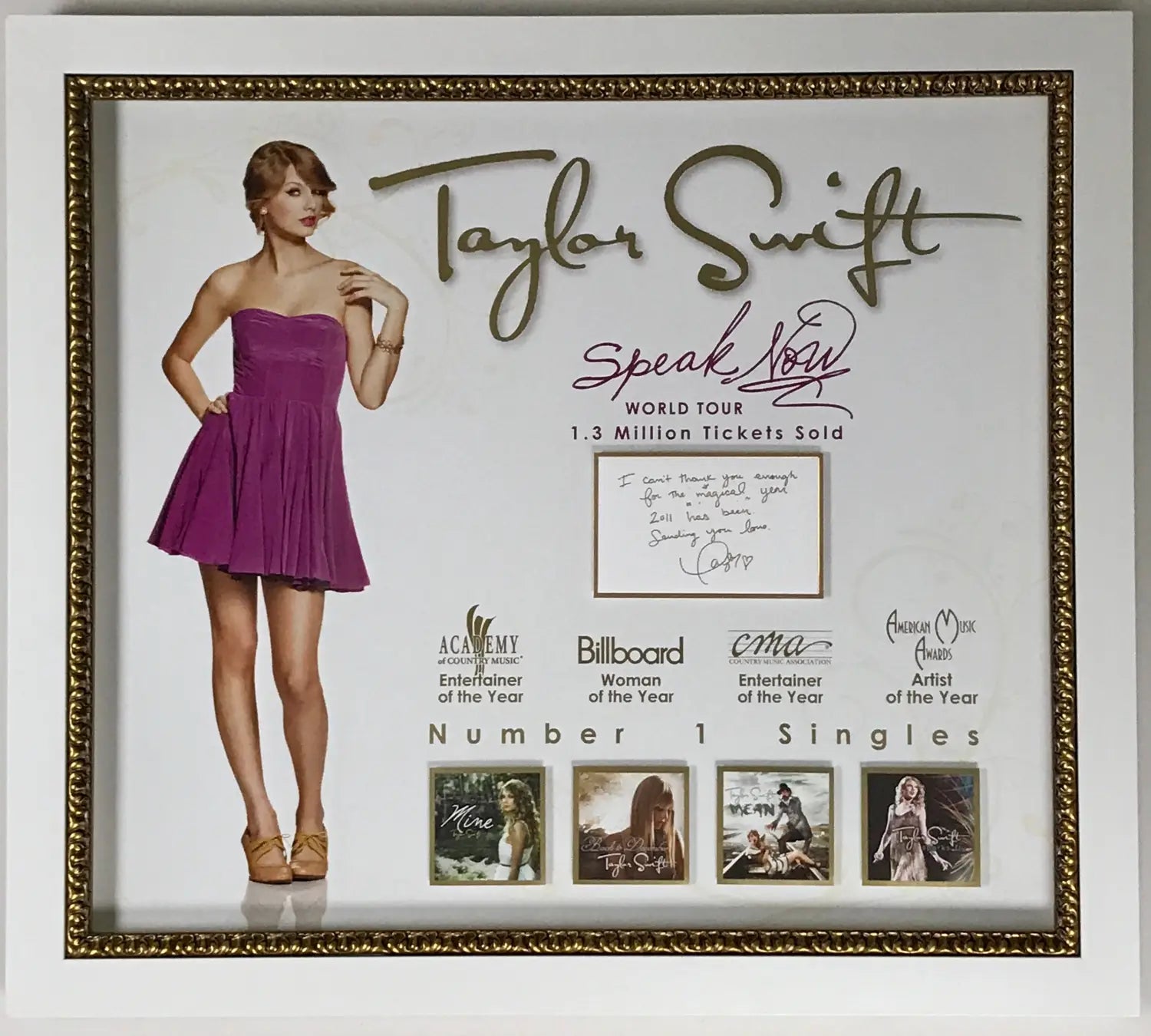

Not all catalog deals involve selling out—some involve reclaiming ownership: Taylor Swift famously re-acquired the master recordings of her first six albums, previously sold in 2019. She achieved this in 2025 and now holds one of the most valuable catalogs ever. Her case underscores a growing artist-empowerment trend—artists seeking to control work and financial destiny, even after major sales.

Meanwhile, artists like Led Zeppelin haven’t had to buy the rights to their song catalog back since the group members largely never gave them up. Although in Zeppelin's case, their late manager Peter Grant is said to have been given a 10% share which is currently held by his daughter.

Challenges & Risks

With skyrocketing valuations come challenges:

• Overheating concern. Some warn of excessive valuations. Hipgnosis, despite its success, faced investor pushback and valuation corrections.

• Interest rate sensitivity. Rising rates increase discount rates for asset valuations, potentially cooling acquisition prices.

• Economic cycles. Catalogs offer resilience, but economic downturns may still dent replay demand, sync spending, or brand licensing.

• Valuation complexity. Despite better data, estimating earnings across future licensing, demographics, and platform trends remains tricky—and deals still rely partly on hype.

Music As An Asset

The rising value of song catalogs marks a pivotal shift: music, once a cultural commodity, is now a fully institutionalized financial asset. Whether acquired by Sony, pumped by private equity, or reclaimed by artists like Taylor Swift, catalogs embody a mix of nostalgia, stable income, global reach, and investment rationality.

At its best, this trend preserves musical legacies, enabling artists—and investors—to monetize enduring cultural creations. Yet as catalog values climb, both artists and investors must tread wisely to balance financial returns with creative stewardship.

That stewardship also should be handled with care. For example, owners of catalogs should employ caution when considering exploiting songs for pure financial gain in placements such as product or service commercials.

Meanwhile, fans will just enjoy the music—remembering that, while someone else may own the rights to a song they love, it will still remain an everlasting legacy of the artist that created it...

Interested in genuine, properly authenticated signed music memorabilia? Check out our selection here. How about genuine RIAA Gold and Platinum and other record awards? Check out our selection here. We typically have hundreds in stock.

Want more content like this? If you're not a subscriber already, sign up for our free MusicGoldmine newsletter which comes out every two weeks. Go here to sign up plus get a code for 15% off your first purchase.

Be the envy of all your friends! Get MusicGoldmine.com Music History in your Facebook feed each day. Just follow us on Facebook here.

*Important Notice/Disclaimer: MusicGoldmine.com is not providing investment advice in any of its' content.

All photos ©MusicGoldmine or public domain